Back

10 Feb 2020

Gold Futures: Further upside likely in the near-term

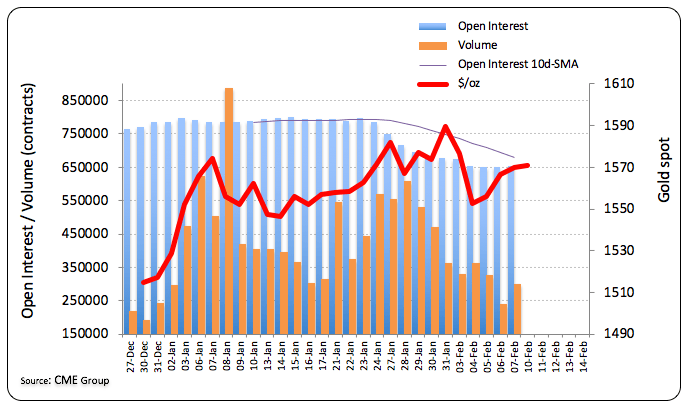

In light of flash data from CME Group for Gold futures markets, traders added almost 2.9K contracts to their open interest positions on Friday, recording the second build in a row. Volume followed suit and rose by nearly 59.9K contracts, reversing two consecutive drops.

Gold: There is still room for a move to $1,600/oz

The ounce troy of Gold remains firm on the back of unremitting concerns around the Chinese coronavirus and its impact on global growth prospects. Rising open interest and volume are supportive of the continuation of the buying pressure, which should initially target the key barrier at $1,600 per ounce.

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com