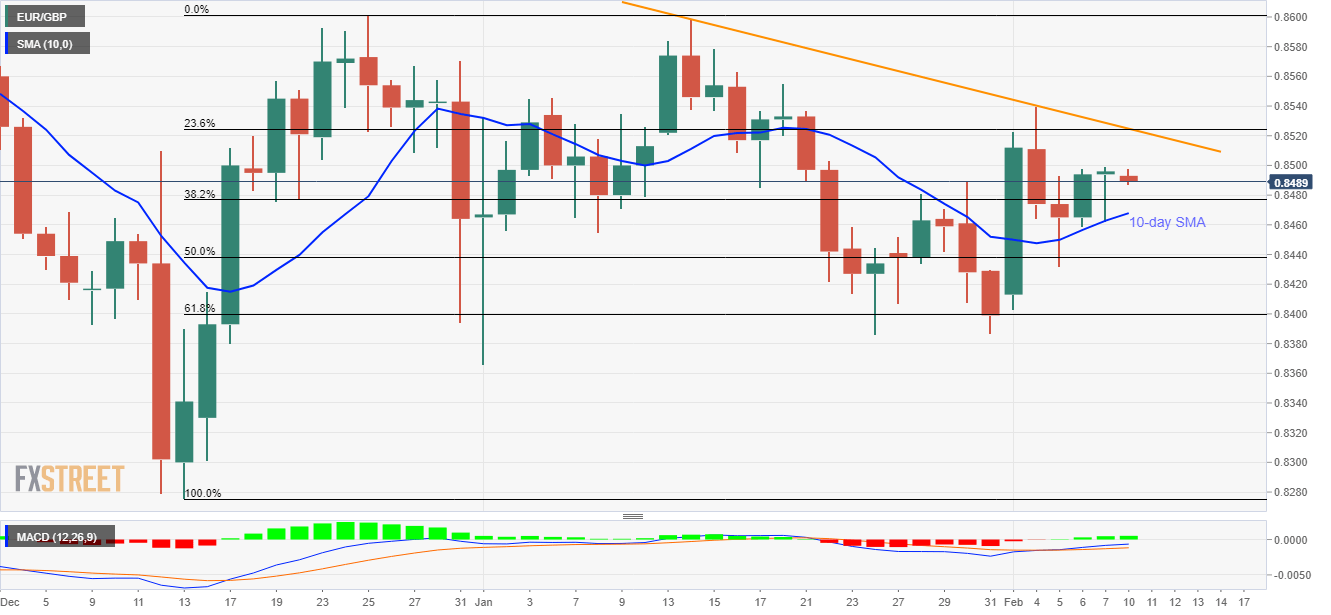

EUR/GBP Price Analysis: 10-day SMA limits immediate declines

- EUR/GBP stays below 0.8500 for fourth-day in a row.

- A falling trend line since January 14 adds to the resistance.

- 50% and 61.8% of Fibonacci retracements could challenge sellers amid bullish MACD.

EUR/GBP registers another pullback from 0.8500 during the pre-Europe session on Monday. That said, the quote currently declines to 0.8490 with 38.2% Fibonacci retracement of December 2019 upside on the sellers’ radar.

While bullish MACD signals fewer chances of the pair’s further weakness, 10-day SMA around 0.8465 adds to the support below 38.2% Fibonacci retracement level of 0.8477.

In a case where the quote slips beneath 0.8465 on a daily closing basis, 61.8% Fibonacci retracement near 0.8400 and multiple bottoms near 0.8390/85 will be the keys to watch for sellers.

On the flip side, the pair’s successful rise above 0.8400 will push the buyers to confront a confluence of monthly falling trend line and 23.6% Fibonacci retracement close to 0.8525.

Additionally, 0.8540 holds the gate for the pair’s run-up beyond 0.8525 towards 0.8600.

EUR/GBP daily chart

Trend: Sideways

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com